Frequently Asked Questions (FAQ)

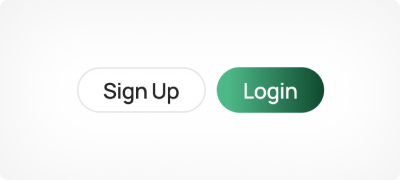

1. Visit www.luxpay.lt and click on “Open Account”

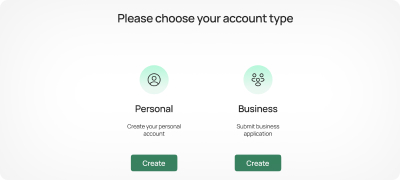

2. Click on “Create your private account”. Do not choose “Submit business application” option. Even if you want to open a business account only, you, as CEO / signatory of the company, must complete KYC check first.

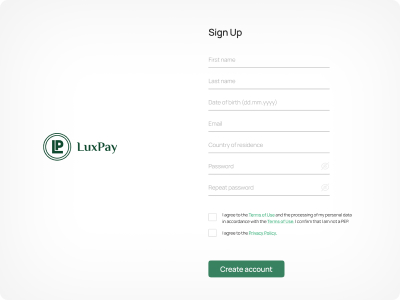

3. Enter your personal information, email address, password which will be used for signing up and press “Create Account”. Accepting our Privacy policy, Terms of use and confirmation you are not a PEP is mandatory. If you are PEP, please contact us by sending email to [email protected]

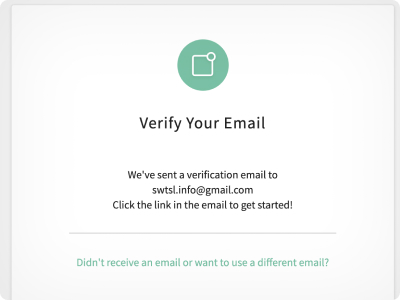

4. You will receive an email with verification link. There is a possibility to re-send verification link or use a different email if needed.

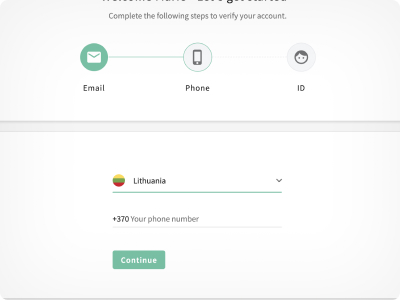

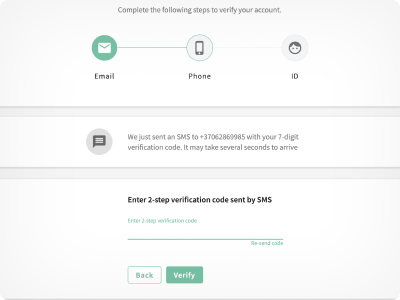

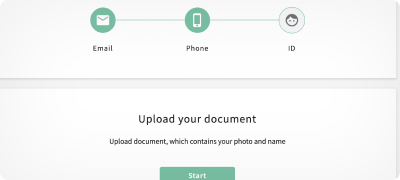

5. After your email is verified, you will be requested to verify your phone number which will be used for signing up. SMS with 6-digit verification code will be sent to provided number.

6. Next step is verification of ID document. You will be requested to choose a country where ID document has been issued and document type. If you are non-EU resident, please perform verification with your passport. Verification can be done using your computer and its webcam or continued on your phone. To complete this step, you will have to take live picture – your ID must be held against the camera.

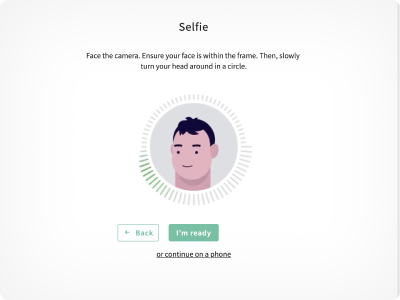

7. After a picture of ID document is taken, you will be asked to take a selfie. This can be done using your computer and its webcam or continued on your phone.

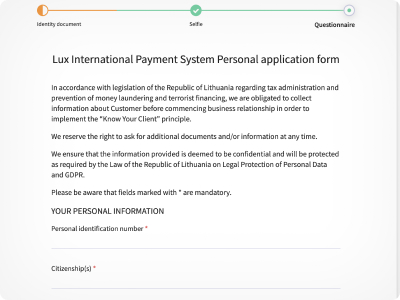

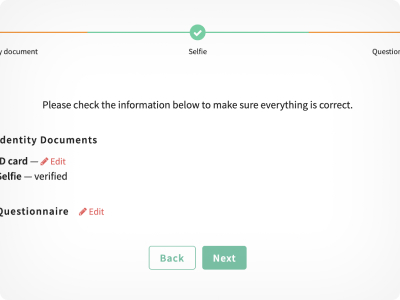

8. Once the selfie is taken, you will be requested to fill in LuxPay Questionnaire. Please note that questions marked with (*) are mandatory.

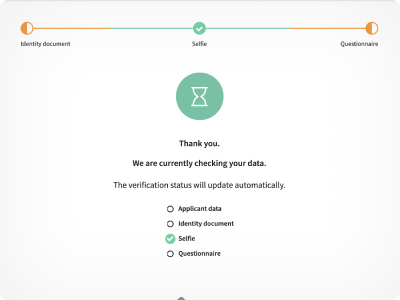

9. Once the Questionnaire is answered and submitted, you will see information that your application is being checked. The system might ask you to re-take picture of your ID due to unsatisfactory results, such as bad lighting.

10. Please note that each applicant is reviewed manually. The system might redirect to your online banking page. However, until your application is approved, you won’t be able to make or receive payments or top-up your account.

LuxPay Compliance department will contact you via email and request additional information and documents if need needed as well as provide you instructions how to make transactions if application is successful. Please contact us via email [email protected] if you have any issues with onboarding process.

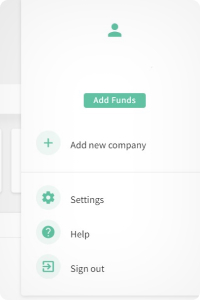

1. In order to apply for business account, CEO / signatory of the Company has to pass our KYC check and open personal account at first. If you do not have personal account, please contact [email protected]. If you do have personal account, go to your online banking, click on your name seen in upper right corner and choose “Add new company”.

2. Fill in all fields about the Company (for Beneficial owner type, please choose “Ultimate beneficial owner”), agree with our Privacy Policy and Terms of Use and click on “Create Company”.

3. Under the “Upload company documents” click on “Start”.

4. Carefully read and agree with processing of Your personal data. Then press “Next”.

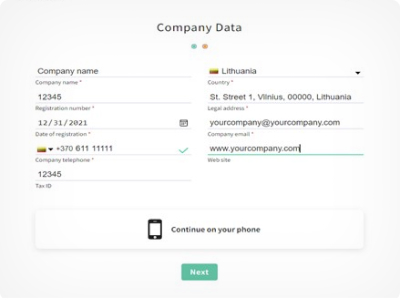

5. Fill in information about the Company and click “Next”. Please note some information will be already pre-filled from section 2.

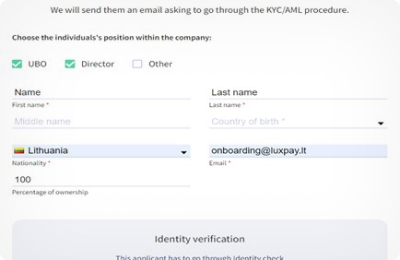

6. Provide information about the UBOs (persons owning at least 25% of the company) and Directors. Choose their positions within the company (one person can be both UBO and Director). You can add persons by clicking “Add participant” if the company has more than one Director and / or UBO. Delete persons by clicking “Remove”. ID documents of UBOs and Directors must be verified. You have two options: click “Start verification now” and the window with the check will open in a new tab. Alternatively, you may send the verification link via email or copy it. We strongly advise you to have prepared high-quality, unedited (saved directly from camera, not resized or saved as PDF) pictures of UBOs / Directors ID documents (both sides of ID card or passport) and perform this step yourself. Then click “Next”.

7. Fill in LuxPay Questionnaire and upload as many requested documents as you possibly can. Please have prepared folllowing corporate documents in advance:

Articles of association/Company’s bylaws Signed by Director/authorized signatory;

Extract from local Business Register With visible Company’s name, address, status, date of incorporation, director/legal representative;

Ownership Structure. Must be dated and signed by Director/authorized signatory. Must include natural and legal persons and % of their equity showing the entire ownership chain from the Applicant’s entity to its beneficial owners – natural persons. During the process, we might require additional documents. Questions marked with (*) are mandatory.

8. Once the Questionnaire is answered and submitted, below window appears. If you notice any errors, details can be edited. If everything is correct, press “SUBMIT”.

9. Your application is being reviewed now. You can review your current verification status by clicking on your company name seen in upper right corner of your internet banking. Then on “Settings” and “Verification”.

Compliance department will contact you via email and request additional information and documents if needed as well as provide you instructions how to make transactions if application is successful. Please contact us via email [email protected] if you have any issues with onboarding process.

1. You need your Passport or your EU ID card and in case of not being resident of the country, a certificate of residency as well.

2. If you would like to open a business account, following documents will be needed:

- Articles of association/Company’s bylaws Signed by Director/authorized signatory.

- Extract from local Business Register with company’s name, address, status, date of incorporation, director/legal representative visible on the document.

- Ownership Structure. Must be dated and signed by Director/authorized signatory. Must include natural and legal persons and % of their equity showing the entire ownership chain from the Applicant’s entity to its beneficial owners – natural persons.

3. The companies established outside of European Union or operating outside of European Union must provide the information requested by LuxPay through its questionnaires, which is mostly the same as the required documents for EU-based companies:

- Extract from Business Register – Full company extract from the official corporate registry, showing key details (name, registration number, status, registered address, shareholders, directors, and UBOs). The customer must also provide a link to a public database where LuxPay can obtain and verify the company’s registry extract.

- If the customer cannot provide such an extract (e.g., the official business register does not contain all necessary data and information), they must provide any available evidence regarding shareholders, directors, and UBOs:

- Certificate of Incorporation

- Shareholder Register – A document listing all shareholders and their ownership percentage.

- Directors Register – A document listing all directors, including their roles and appointment dates.

- Good Standing Certificate (if applicable) – Proof that the company is still active and compliant with local regulations.

- Business License(s) – If the company operates in a regulated industry (e.g., financial services, crypto, etc.), it must provide a valid business license.

IMPORTANT : All documents must be recent (not older than 3 months), translated into English, and legalized/apostilled. Legalization is not required if LuxPay can verify all data in reliable open sources.

- UBO and Management (Directors, Board, if any) documents:

- Passport copies of all UBOs (owning 25%+ shares), directors, and authorized signatories – Must be clear, valid, and certified.

- Proof of Address of UBOs, directors, and authorized signatories – Recent utility bill, bank statement, or tax document (issued within the last 3 months).

- Power of Attorney(if applicable) – If someone is acting on behalf of the company, a notarized/apostilled POA is needed.</li class=’dash’>

- Selfie Photo of UBOs and directors

- Completed KYC Questionnaire.

- Based on the customer’s risk level, LuxPay reserves the right and, in some cases, has the duty to request additional information and documents,such as:

- Proof of Wealth / Source of Funds of UBOs – Documents proving how the Company and UBOs acquired their wealth (e.g., tax returns, salary slips, dividends, property sale agreements).

- Articles of Association (AoA) / Memorandum of Association (MoA)

- Contracts or Invoices with Suppliers & Clients and other documentation.

Additional documents might be requested depending on applicants profile and background.

You will be contacted via e-mail by LuxPay team.

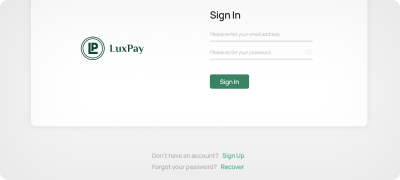

1. Open the link: https://client.luxpay.lt/sign-in

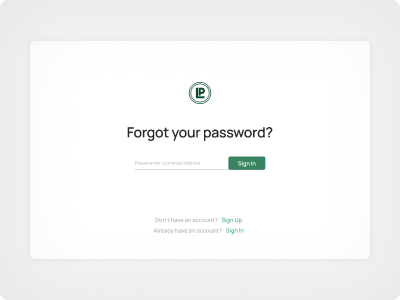

2. Press on “Recover” button.

3. Enter your e-mail and press “Reset” button.

4. Check your mailbox, you will receive e-mail with following instructions.

5. Welcome to your new internet banking.

At the moment, we provide EUR, GBP and USD currencies. AED currency will be available in the near future.

Please note! At this time, USD available only for the outgoing payments. USD incoming payments will be available in the near future.

The list of prohibited jurisdictions:

- Afghanistan

- Barbados

- Belarus

- Burkina Faso

- Cambodia

- Democratic Republic of the Congo

- Crimea (Region of Ukraine)

- Cuba

- Haiti

- Yemen

- Iran

- Iraq

- Democratic People’s Republic of Korea

- Libya

- Mali

- Myanmar

- Nicaragua

- Pakistan

- Panama

- Philippines

- Russia

- Senegal

- Syria

- South Sudan

- Trinidad and Tobago

- Uganda

- Zimbabwe

The list of prohibited business fields:

- Adult entertainment

- Shell banks and companies

- Counterfeit items

- Signal Jammers/Blockers that interferes with cellular/communication devices

- Credit repair services

- Stolen goods including digital and virtual goods

- Drugs or drug proprietors selling illegal substances

- Surrogacy services

- Drug paraphernalia that involves equipment designed for making or using drugs

- Tattoo Parlours

- Espionage equipment and accessories

- Tobacco / Cigar / Electronic Cigarette / Nicotine content products

- Human remains and body parts

- Trade of weapons, ammunition, military arms, explosive devices and firearm parts

- Illegal investment schemes

- Gambling without a license

- Illegal downloads of movies, music, computer and video games

- Any other category, products or services that LuxPay decides to prohibit, in its sole discretion.

- Illegal software – e.g. Malware, Software to break encryption of phones/computers

- Charities or Not-For-Profit Organizations / NGO’s

- Illegal sale of financial information (e.g. bank accounts, bank cards)

- Non-account customers

- Mail order brides services

- Arms, defense, military

- Poisonous and hazardous materials

- Atomic power

- Products/Services promoting abuse, hatred, racism, religious persecution, terrorism, violence or contain offensive content

- Extractive industries

- Pyramid or ponzi schemes

- Embassies/Consulates

- Sanction list inclusions (global)

- Dedicated (individual) IBANs

- Access to the e-wallet

- Local and cross-border payments in EUR, GBP and USD

- 1st and 3rd party payments

- Payment cards

- Easy and understandable platform

Supported currencies:

- EUR

- GBP

Supported payment rails:

- SEPA

- Target2

- SWIFT

- Faster Payment

- Fedwire

- ACH

We do our best to process and send your transfer to the recipient as fast as possible, however, in some cases the payment can be in a pending state a bit longer. If you see that your payment is in pending state, this simply means that it is being processed by one of our payment processors. This process can take up to 2 business days. After you see that payment is in completed state, it means that it is on the way to the recipient.

To avoid any issues and delays, please make sure that the recipient account details are correct.

First of all, please make sure that you have sufficient balance on your account to make a payment. Alternatively, payment also may be declined if you are attempting to send funds to an unsupported merchant. If you are still having issues submitting a payment, please contact our support team and we will do our best to help.

In order to submit a payment, you have to obtain following recipient details:

- Recipient full name (Same as declared in the recipient’s bank)

- BIC/SWIFT code – a bank code that has 8 or 11 characters

- Recipient’s IBAN – an account number under the recipient’s bank

The timeframe for payment to arrive is started to calculate after you can see it‘s status as ‘Completed’. Estimated timeframes for the payment to arrive are:

SWIFT payments – up to 5 working days (usually 3 working days)

SEPA payments – up to 2 working days (usually 1 wokring day)

Please note! This is an estimation, not a guarantee. In some cases, it might take slightly longer for the payment to reach its destination:

- Some banks and financial institutions do not process payments during weekends and bank holidays.

- Some banks and financial institutions may take a longer time to process payments.

- Some banks and financial institutions are required to make additional checks on your payments to comply with regulations.

EUR payments within SEPA usually arrive on the same day, but might take up to 2 working days.

International payments (SWIFT) usually reach recipient within 5 working days.

Payment timeframes are estimated and can vary from time to time due to the changes we make to improve our processing systems.

International payments, in other words called SWIFT (Society for Worldwide Interbank Financial Telecommunication) payments, are those, which sent to or received from accounts in other countries or payments that are not in your base currency but are from an account in your country.

International money transfers are basically inter-bank transfers, however, if two banks are located in different countries, it makes things slightly more complex. The principle of correspondent banking applies, which means that two banks need to have an established relationship in order to facilitate a SWIFT transfer. SWIFT does not actually send money, it simply sends messages between the banks. Because of this, other systems that require more human intervention must be used to transfer the actual funds and this, in turn, makes SWIFT transfers slow. What’s more, the complex nature of these transfers usually incurs a fee which nearly always gets passed on to consumers.

If senders’ and recipient banks do not have direct relationships, one or more intermediary banks must be found to facilitate the transfer. Unfortunately, each participant of the payment chain might charge its own fees for processing a relevant payment.

LuxPay does charge processing fees for transferring money internationally as per pricelist. However, a beneficiary or an intermediary bank might additionally charge their own fees for processing an international transfer.

A bank that is sending funds to your account could also charge a fee. When your money is in transit, it might be processed by an intermediary bank who might also deduct a handling fee. Therefore, the amount received might be less than the amount sent

Additionally, you may be charged an FX mark-up if payment is instructed in different currency that a recipient account is able to receive.

We can provide an estimate of the potential fees charged by the beneficiary/intermediary banks for processing a SWIFT payment for the following currencies:

- From 15 EUR

- From 20 USD

- From 15 GBP

- From 50 AED

Please note! Potential fees mentioned above do not include fees charged by Luxpay.